Strategic analysis of market demand and operational costs for SAE and Metric wheel fasteners is crucial for product line simplification. Effective Standardization, Inventory Management ensures optimal inventory depth. This involves focusing on one dominant standard or managing a dual-standard inventory carefully. Such a strategy promotes efficient Standardization,Inventory Management practices.

Key Takeaways

- SAE and Metric fasteners are different. You must use the correct type for safety. Using the wrong one can damage your vehicle.

- Simplifying your product line saves money. It makes your business run smoother. This means fewer items to manage and lower storage costs.

- Good inventory management helps you stock the right fasteners. You can meet customer needs. This avoids having too much or too little of any item.

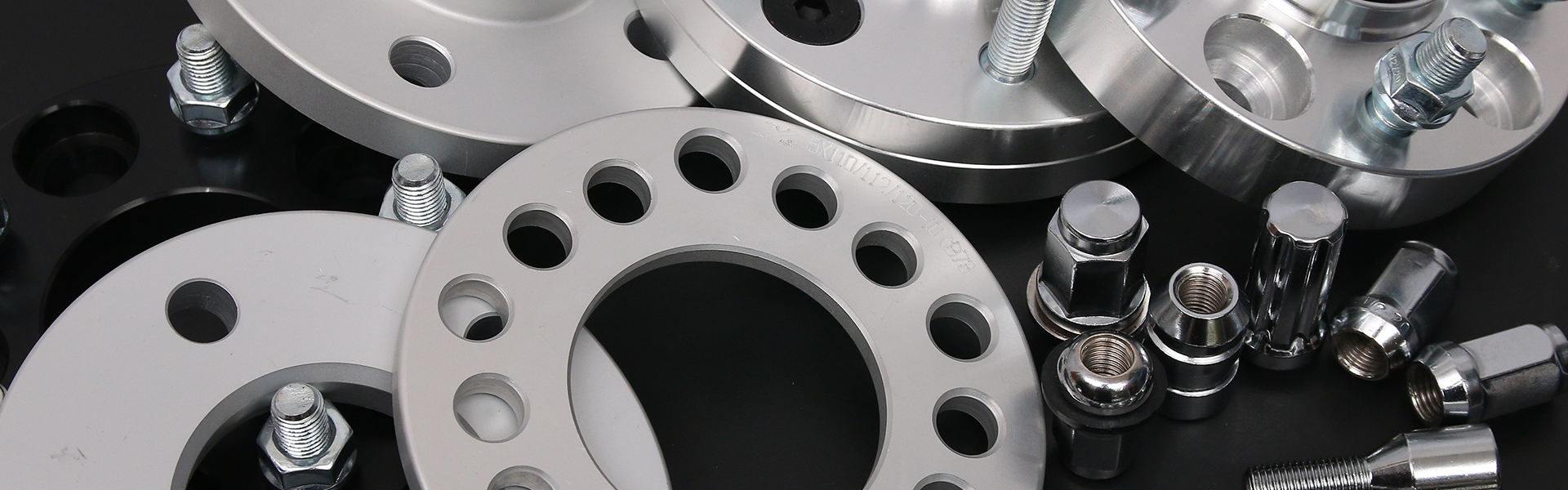

Understanding SAE and Metric Wheel Fasteners

Key Differences in Threads, Sizes, and Applications

SAE and Metric wheel fasteners represent two fundamental measurement systems. SAE fasteners, also known as imperial fasteners, rely on units like inches and fractions. They feature specific thread designations, such as Unified National Coarse (UNC) or Unified National Fine (UNF). Metric fasteners, in contrast, utilize the millimeter system. Their threads are defined by pitch, which measures the distance between adjacent threads. Manufacturers typically apply SAE fasteners in older American vehicles and some heavy equipment. Modern vehicles, particularly those from European and Asian markets, predominantly use metric fasteners.

Historical Context and Market Dominance

Historically, SAE fasteners held significant dominance within the United States automotive industry. American manufacturers widely adopted this standard for many decades. However, the global automotive market experienced a substantial shift. Metric fasteners achieved widespread acceptance internationally. Today, most vehicle manufacturers worldwide, including many U.S.-based companies, primarily employ metric standards for new vehicle production. This transition reflects a broader global movement towards unified manufacturing practices and standardization.

Interchangeability Challenges and Safety Implications

SAE and Metric wheel fasteners are fundamentally not interchangeable. Their distinct thread patterns and size specifications prevent proper fitment. Forcing a mismatched fastener can severely damage or strip threads on the wheel stud or lug nut. This improper fit creates substantial safety risks. A loose wheel or a complete fastener failure can lead to catastrophic vehicle malfunction during operation. Technicians must always verify and use the exact correct fastener type for each application. This ensures vehicle integrity and paramount occupant safety.

The Imperative for Product Line Simplification and Standardization

Benefits of Reduced SKU Count and Lower Holding Costs

Businesses gain significant advantages from reducing their Stock Keeping Unit (SKU) count. Fewer SKUs directly translate to lower holding costs. Companies spend less on warehousing space, insurance, and inventory taxes. They also reduce the risk of obsolescence, which occurs when products become outdated or unsellable. A simplified product line frees up capital. This capital would otherwise remain tied up in excess inventory. Businesses can then invest this money into other growth opportunities or operational improvements. This financial efficiency directly impacts a company’s bottom line.

Operational Streamlining and Enhanced Efficiency

Simplifying a product line significantly streamlines operational processes. Purchasing departments manage fewer unique items. This reduces the complexity of supplier negotiations and order placement. Receiving and stocking processes become faster and more accurate. Warehouse personnel locate and pick items with greater ease. This leads to quicker order fulfillment and reduced labor costs. Training for new employees also becomes simpler. They learn fewer product variations. Overall, a streamlined operation enhances efficiency across the entire supply chain.

Navigating Customer Needs and Market Diversity

Companies must carefully balance simplification with meeting diverse customer needs. Market research helps identify dominant demand patterns for specific fastener standards. For example, a company might find a strong preference for metric fasteners in its primary market. This allows them to prioritize metric inventory. However, some customers may still require SAE fasteners for older equipment or niche applications. Businesses can choose to maintain a limited, carefully managed inventory for these specific needs. This approach ensures customer satisfaction without overcomplicating the entire product line. Strategic choices allow companies to serve their market effectively.

Identifying Consolidation Opportunities

Businesses actively seek opportunities to consolidate their product offerings. They analyze sales data to identify slow-moving or redundant SKUs. They also review supplier relationships. This helps them find commonalities between different fastener types. For instance, a company might discover two fasteners with slightly different dimensions but similar applications. They can then explore if one fastener can replace the other. This process often involves cross-referencing parts and identifying direct replacements. Consolidating suppliers also reduces administrative overhead. This strategic review helps companies optimize their product portfolio and improve overall Standardization, Inventory Management.

Strategies for Optimizing Inventory Depth Management

Analyzing Demand Patterns for Each Fastener Standard

Effective inventory management begins with a thorough understanding of demand. Businesses must meticulously analyze demand patterns for both SAE and Metric wheel fasteners. This analysis involves reviewing historical sales data. It also includes examining current market trends. Companies identify peak seasons, regional preferences, and customer segments. For instance, a market serving older American vehicles will show higher SAE demand. Conversely, a market dominated by newer imports will prioritize Metric fasteners. This detailed insight allows businesses to allocate resources effectively. They can then stock the right quantities of each fastener type. This prevents both overstocking and stockouts.

Forecasting Techniques for Dual-Standard Inventory

Managing a dual-standard inventory requires sophisticated forecasting techniques. Companies cannot simply apply a single forecast model to their entire fastener inventory. They must develop separate forecasts for SAE and Metric items. Time-series analysis helps predict future demand based on past sales. Moving averages smooth out short-term fluctuations. Exponential smoothing gives more weight to recent data. Businesses also consider external factors. These include new vehicle sales, economic indicators, and competitor actions. Combining these techniques provides a more accurate picture. This allows for proactive adjustments to inventory levels. It ensures the availability of critical fasteners.

Implementing Just-In-Time (JIT) or Safety Stock Methodologies

Businesses employ specific inventory methodologies to optimize depth. Just-In-Time (JIT) minimizes inventory holding costs. It involves ordering fasteners only when needed for production or sale. JIT works best for high-volume, predictable items. It requires strong supplier relationships and reliable delivery. For less predictable or critical fasteners, companies use safety stock. Safety stock acts as a buffer against unexpected demand spikes or supply chain disruptions. Calculating safety stock involves considering lead time variability and desired service levels. A company might use JIT for common Metric lug nuts. They might maintain safety stock for specialized SAE wheel bolts. This balanced approach ensures operational continuity.

Leveraging Data Analytics for SKU Performance and Obsolescence

Data analytics plays a crucial role in modern inventory management. Companies use analytics to track SKU performance. They monitor sales velocity, inventory turnover rates, and gross margin return on investment (GMROI). This data identifies fast-moving items and slow-moving items. Analytics also helps detect potential obsolescence. For example, a specific SAE fastener might show declining sales over several quarters. This indicates a need to reduce its inventory depth or phase it out. Predictive analytics can forecast future demand and obsolescence risk. These insights enable data-driven decisions. They help optimize inventory levels and prevent financial losses from outdated stock. Effective Standardization, Inventory Management relies heavily on these analytical capabilities.

Developing and Implementing a Simplification Strategy

Comprehensive Market Research for Demand Trends

Businesses must conduct comprehensive market research. This research identifies current and future demand trends for wheel fasteners. It involves analyzing sales data, customer feedback, and industry reports. Companies determine the prevalence of SAE versus Metric standards in their target markets. This insight helps predict future needs. For example, a market with many new European vehicles will show high metric demand. Understanding these trends guides strategic decisions. It ensures the product line aligns with customer expectations.

Cost-Benefit Analysis of SKU Reduction

A thorough cost-benefit analysis is essential for SKU reduction. This analysis quantifies the savings from fewer unique products. It includes reduced inventory holding costs, less warehouse space, and lower insurance expenses. Businesses also consider the operational efficiencies gained. These include simpler purchasing, faster order fulfillment, and less training. The analysis weighs these benefits against potential risks, such as losing niche customers. This data-driven approach justifies investment in simplification efforts. It highlights the financial advantages of a streamlined product offering.

Supplier Consolidation and Negotiation for Preferred Standards

Companies benefit from consolidating their supplier base. Working with fewer suppliers simplifies procurement processes. It also strengthens negotiation power. Businesses can negotiate better pricing and terms for their preferred fastener standards. For instance, they might secure favorable deals for metric fasteners if those dominate their market. This strategy reduces administrative overhead. It also improves supply chain reliability. Effective supplier relationships are crucial for successful Standardization, Inventory Management.

Internal and External Communication and Training

Successful simplification requires clear communication. Businesses must inform internal teams about changes to the product line. This includes sales, marketing, and warehouse staff. Training ensures everyone understands the new inventory structure and product offerings. External communication informs customers about any changes. This might involve new part numbers or alternative product recommendations. Transparent communication minimizes confusion. It ensures a smooth transition for both employees and customers.

Real-World Applications and Success Stories

Case Study: Transitioning to a Predominantly Metric Line

A large automotive parts distributor faced challenges with an extensive, unoptimized inventory. They stocked many SAE and Metric wheel fasteners. Market analysis revealed a significant shift. Newer vehicle models predominantly used metric fasteners. The company initiated a strategic transition. They conducted a detailed SKU performance review. This identified slow-moving SAE items. They gradually reduced orders for these less popular parts. Simultaneously, they increased their inventory depth for high-demand metric fasteners. This strategy led to a 20% reduction in overall SKU count. It also lowered holding costs by 15%. The company improved order fulfillment rates for modern vehicles. Their customers appreciated the readily available metric parts.

Case Study: Optimizing Dual-Standard Inventory Management

A heavy equipment supplier served a diverse client base. Their customers operated both older machinery (requiring SAE) and newer equipment (requiring Metric). The supplier could not eliminate either standard. They implemented a sophisticated dual-standard inventory management system. They used advanced data analytics to track demand patterns for each fastener type. For high-volume, predictable metric fasteners, they adopted a Just-In-Time (JIT) approach. This minimized stock levels. For specialized, critical SAE fasteners, they maintained a carefully calculated safety stock. This ensured availability for emergency repairs. This balanced strategy reduced inventory obsolescence by 10%. It also maintained a 98% service level for all fastener types. The company successfully met varied customer needs without excessive inventory investment.

Effective product line simplification and inventory depth optimization for wheel fasteners require a strategic assessment of SAE and Metric standards. Businesses must balance market demand, operational efficiency, and a clear implementation plan. This approach is essential for achieving cost savings and ensuring customer satisfaction. A well-executed strategy leads to reduced complexity, improved profitability, and enhanced customer service through better Standardization, Inventory Management.

FAQ

What distinguishes SAE from Metric wheel fasteners?

SAE fasteners use inches and fractions for measurement. Metric fasteners use millimeters and thread pitch. They represent different measurement systems.

Can technicians interchange SAE and Metric wheel fasteners?

No, they are not interchangeable. Mismatched fasteners cause damage. This creates significant safety risks for vehicles.

What is the main advantage of product line simplification?

Simplification reduces SKU count. This lowers holding costs and improves operational efficiency. Businesses save money and streamline processes.

Post time: Nov-13-2025