When importing bulk TPMS kits, it’s crucial to identify and mitigate hidden costs. Streamlining customs processes directly reduces your overall Import Cost. Selecting efficient logistics partners significantly impacts your end-to-end Shipping, further optimizing your Import Cost. Leveraging trade agreements offers substantial opportunities for duty reduction, enhancing your overall shipping efficiency.

Key Takeaways

- Understand all costs beyond the purchase price, like duties and shipping, to know your true import cost.

- Use correct product codes and free trade agreements to lower the taxes you pay on imported goods.

- Choose good shipping partners and methods to balance cost and speed for your deliveries.

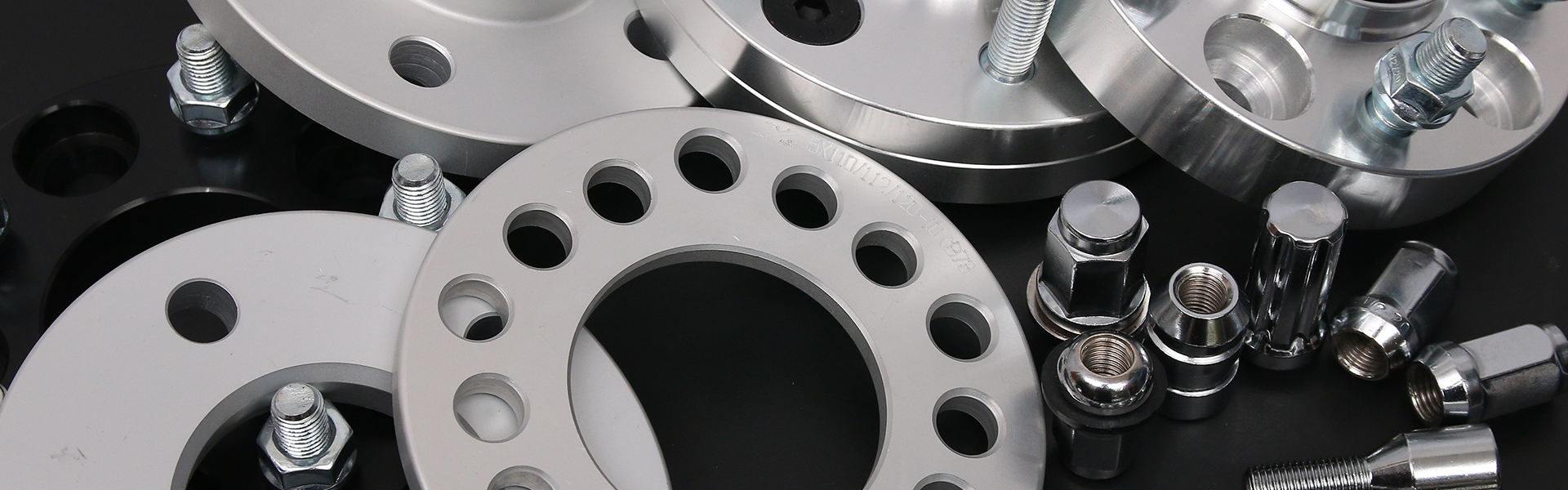

Understanding the Total Landed Cost of TPMS Kit Imports

Deconstructing the True Import Cost Beyond Purchase Price

You must look beyond the initial purchase price of your bulk TPMS kits. The true cost, known as the total landed cost, includes many other elements. These elements directly impact your overall Import Cost. You will account for duties, taxes, freight charges, insurance, and customs clearance fees. You also consider warehousing and local transportation. Understanding these components helps you budget accurately. It prevents unexpected expenses.

Key Cost Drivers in Bulk TPMS Kit Shipping

Several factors significantly drive up the cost of bulk TPMS kit Shipping. Freight rates fluctuate based on fuel prices, volume, and demand. You also face insurance premiums protecting your goods during transit. Handling fees at ports and warehouses add to the expense. Customs duties and tariffs are major cost drivers. You must also consider any specialized packaging or handling your TPMS kits require.

The Impact of Incoterms on Cost Allocation and Responsibility

Incoterms (International Commercial Terms) define the responsibilities of buyers and sellers. They specify who pays for and manages the shipment at each stage. For example, under “FOB” (Free On Board), you, as the buyer, assume costs and risks once the goods are loaded onto the vessel. Under “DDP” (Delivered Duty Paid), the seller handles almost all costs, including duties, until delivery. Your choice of Incoterm directly impacts your final Import Cost and your operational burden.

Strategic Customs Compliance for Reduced Import Cost

Accurate HTS Classification for Duty Calculation

You must correctly classify your TPMS kits. The Harmonized Tariff Schedule (HTS) code determines the duty rate you pay. An incorrect HTS code can lead to overpaying duties. It can also result in underpaying duties, which brings penalties and delays. You find the HTS code for each item you import. This code is a multi-digit number. It precisely identifies your product. You can research the HTS online through the U.S. International Trade Commission (USITC) website. Consider seeking expert advice if your products are complex. Accurate classification prevents customs issues. It ensures you pay the correct amount.

Leveraging Free Trade Agreements and Special Programs

You can significantly reduce your Import Cost by using Free Trade Agreements (FTAs). The United States has FTAs with many countries. These agreements allow for reduced or even zero duties on eligible goods. For example, the USMCA (United States-Mexico-Canada Agreement) offers duty benefits. You must ensure your TPMS kits meet the “Rules of Origin” requirements. These rules specify where the product was made. You also need proper documentation, like a Certificate of Origin. Beyond FTAs, special programs exist. The Generalized System of Preferences (GSP) is one such program. It offers duty-free treatment for certain products from developing countries. You should investigate all available agreements and programs. They can provide substantial savings.

Valuation Methods to Ensure Compliance and Avoid Penalties

Customs duties are often calculated based on the value of your imported goods. You must declare the correct customs value. The primary method is “transaction value.” This means the price you actually pay for the goods. However, you must include other costs in this value. These can include packing costs, certain selling commissions, and “assists.” Assists are items you provide to the seller for production, like molds or tools. Undervaluing your goods can lead to severe penalties. Customs can seize your shipment. They can also fine you heavily. You must maintain accurate records. These records support your declared value. This ensures compliance and avoids costly mistakes.

Partnering with a Knowledgeable Customs Broker

Navigating customs regulations is complex. You benefit greatly from partnering with a knowledgeable customs broker. A broker acts as your agent. They handle all customs clearance procedures. They ensure your documentation is correct and complete. A good broker helps you with HTS classification. They advise you on valuation methods. They also identify opportunities for duty reduction, like FTAs. Their expertise minimizes errors and speeds up clearance. This reduces delays and potential penalties. A customs broker helps you stay compliant. They save you time and money in the long run.

Optimizing Logistics and Shipping for Cost Efficiency

Freight Forwarder Selection for Balancing Cost, Speed, and Reliability

You need a reliable partner for your bulk TPMS kit imports. A freight forwarder manages the complex process of moving goods. They handle customs clearance, documentation, and transportation. You must select a forwarder carefully. Consider their experience with electronics or automotive parts. Look for a forwarder offering a balance of cost, speed, and reliability. The cheapest option is not always the best. Delays or damage can cost you more in the long run. Ask about their communication protocols. You need clear updates on your shipment’s status. Evaluate their network. A strong global network ensures smooth transitions across different legs of the journey. A good freight forwarder becomes an extension of your team. They help optimize your entire Shipping process.

Mode of Transport Analysis: Sea vs. Air for Bulk TPMS Kits

Choosing the right transport mode significantly impacts your costs and delivery times. You have two primary options: sea freight and air freight.

- Sea Freight: This is generally the most cost-effective for bulk TPMS kits. You can ship large volumes at a lower per-unit cost. Sea freight is slower. Transit times can range from several weeks to over a month. This option suits non-urgent orders. You can choose Full Container Load (FCL) if your volume fills a container. Less than Container Load (LCL) is an option for smaller volumes. LCL combines your goods with others.

- Air Freight: Air freight offers speed. Your TPMS kits arrive much faster, often within days. This speed comes at a higher cost. Air freight is suitable for urgent orders or high-value, low-volume shipments. You might use air freight for initial stock or to meet unexpected demand spikes.

You must weigh the cost savings of sea freight against the speed of air freight. Consider your inventory holding costs. Faster delivery reduces the time your capital is tied up in transit. This decision directly affects your supply chain’s agility.

Consolidation Strategies to Reduce Per-Unit Shipping Costs

You can significantly lower your per-unit Shipping costs through consolidation. Consolidation involves combining multiple smaller shipments into one larger shipment. This strategy is particularly effective for LCL sea freight. Instead of paying for individual small packages, you pay for a portion of a larger container.

- Multi-Vendor Consolidation: If you source TPMS kits from different suppliers in the same region, a freight forwarder can collect them. They combine these into a single container shipment. This reduces the number of individual customs clearances. It also lowers handling fees.

- Cross-Docking: Goods arrive at a warehouse. They are immediately sorted and transferred to outbound trucks. This minimizes storage time. It streamlines the flow of goods.

- Buyer’s Consolidation: Your freight forwarder collects goods from various suppliers. They then consolidate them into a full container. This gives you greater control over the container. It also reduces costs.

These strategies reduce overall freight charges. They also simplify documentation. This leads to a more efficient and cost-effective import process.

Warehousing and Distribution for Proximity to Market

Your warehousing and distribution strategy plays a crucial role in your end-to-end cost. You need to position your inventory strategically. Locating warehouses closer to your major customer bases reduces last-mile delivery costs. It also speeds up delivery times.

- Proximity to Market: A warehouse near key distribution hubs or large customer populations minimizes domestic transportation expenses. It allows for quicker order fulfillment.

- Types of Warehousing: You can use public warehouses for flexibility. They offer shared space and services. Private warehouses give you full control. Bonded warehouses allow you to store imported goods before paying duties. This can improve cash flow.

- Distribution Network Design: Design an efficient network. This might involve a central distribution center. It could also include regional hubs. This ensures your TPMS kits reach customers quickly and affordably. Effective warehousing reduces transit times. It also lowers overall logistics expenses.

Mitigating Risks and Unexpected Import Costs

Insurance for Protecting Against Loss and Damage

You must protect your investment in bulk TPMS kits. Marine cargo insurance safeguards your goods during transit. It covers loss, damage, or theft. Without insurance, you bear the full financial burden of any incident. This can significantly increase your overall Import Cost. Choose a policy that matches your specific needs. Consider coverage for all legs of the journey, from factory to warehouse. A small premium provides significant peace of mind. It protects you from unforeseen financial setbacks.

Avoiding Demurrage and Detention Charges

You can incur significant extra costs from demurrage and detention. Demurrage charges apply when your container remains at the port terminal beyond the free time. Detention charges occur when you keep the container outside the port beyond the free time. Both result from delays in customs clearance or unloading. You must ensure prompt documentation submission. Coordinate efficiently with your customs broker and trucking company. Plan your logistics carefully to avoid these avoidable fees.

Staying Ahead of Regulatory Changes and Compliance Updates

You need to monitor regulatory changes constantly. Customs laws, tariffs, and product safety standards evolve. New regulations can impact your Shipping schedule or duty rates. Subscribe to industry newsletters. Work closely with your customs broker. They can provide timely updates. Staying informed helps you adapt quickly. This prevents non-compliance penalties and unexpected delays. Proactive management ensures smooth import operations.

Supply Chain Visibility for Proactive Problem Solving

You gain significant advantages from full supply chain visibility. Knowing the exact location of your TPMS kits at all times is crucial. Real-time tracking systems provide this insight. You can identify potential delays early. This allows you to address issues before they escalate. Visibility helps you manage inventory levels effectively. It also enables proactive communication with customers. This capability minimizes disruptions and improves overall efficiency.

Leveraging Technology and Data for Continuous Cost Optimization

Utilizing Trade Management Software for Compliance and Cost Tracking

You can significantly enhance your import operations with trade management software (TMS). This technology centralizes all your import data. It helps you manage HTS classifications accurately. You track duties, taxes, and various fees in real-time. A TMS ensures compliance with evolving regulations. It also provides a clear overview of your total landed cost for each TPMS kit. This visibility allows you to make informed decisions. You identify cost-saving opportunities quickly.

Data Analytics for Identifying Trends and Improvement Areas

You gain powerful insights from analyzing your import data. Data analytics tools reveal important trends. You can spot inefficiencies in your supply chain. For example, you might discover certain routes consistently incur higher costs. You identify suppliers with frequent delays. This data helps you optimize your freight forwarder selection. You negotiate better rates. You also refine your inventory management strategies. Continuous analysis drives ongoing cost reduction.

Automation in Documentation and Communication for Efficiency

Automation streamlines many manual tasks in your import process. You can automate the generation of customs declarations. This reduces human error. It also speeds up documentation processing. Automated communication systems keep all parties informed. Your customs broker, freight forwarder, and internal teams receive updates instantly. This efficiency minimizes delays. It also lowers administrative costs. You achieve faster clearance times and a more agile supply chain.

You optimize your Import Cost through proactive management of customs, duties, and logistics. Continuous adaptation to market and regulatory changes helps you sustain significant cost savings. Strategic planning leads to improved profitability and gives you a strong competitive advantage in bulk TPMS kit imports.

FAQ

What is the most important factor for reducing my TPMS kit import costs?

You must accurately classify your goods with the correct HTS code. This directly determines your duty rates. Correct classification prevents overpayments and avoids penalties.

How do Incoterms affect my import responsibilities and costs?

Incoterms clearly define who pays for and manages each part of the shipment. Your choice directly impacts your final import cost and operational duties.

Should I always choose the cheapest freight forwarder for my bulk TPMS kits?

No, the cheapest option is not always the best. You need to balance cost with speed and reliability. Delays or damage can cost you more in the long run.

Post time: Nov-04-2025